Mortgage Broker Newcastle

Get The Best Mortgage Deals With Deedle in Newcastle, Tyne and Wear, and the North East Area

Whether you are looking for your first mortgage in Newcastle, or you are a next time buyer, looking to remortgage or purchase a buy to let property, Deedle can help you today.

Tell us your requirements and receive a same day callback from our expert advisers today!

Begin Your Mortgage Journey Today

What Mortgages Can I Get in Newcastle?

There are many different types of mortgages you can get in Newcastle including residential and buy to let mortgages. There are many options for first time buyers and next time buyers including repayment or interest only mortgages.

As well as this, Deedle can connect you to lenders who offer Affordable Housing scheme mortgages in Newcastle, equity release mortgages, bad credit mortgages, mortgages with a guarantor, self employed mortgages, joint mortgages and low income mortgages to name a few. There is also the option to remortgage a property in Newcastle or to remortgage with bad credit.

How To Apply For A Mortgage In Newcastle

Fill in Our Enquiry Form

Receive A Callback

Check If You Qualify

Receive Your Newcastle Mortgage

How Much Deposit Do I Need For A Mortgage In Newcastle?

Lenders in Newcastle usually expect a deposit of at least 5-20% of the property’s purchase price. With the average price of a properties in Newcastle totalling around £215,000, a typical deposit will range between £10,750 and £43,000 on average.

Normally the higher the deposit, the lower the interest rates you will be offered. So it is ideal to save closer to 20% of the property’s full value if you can. The amount you need to pay for the deposit will also depend on the property’s value, the lender’s criteria and your financial situation.

Different Types of Mortgages Available in Newcastle

Fixed Rate Mortgages

-

A fixed rate mortgage allows borrowers to fix their mortgage rate for 2 to 15 years.

-

Repayments stay the same during that time.

-

You can usually overpay by 10% a year to reduce the total loan amount. Any more than this could lead to early repayment charges.

Discount Variable Rate Mortgages

-

Discounted variable rate mortgages mean that borrowers get a discounted rate for some time, usually between 2 and 5 years.

-

These mortgages tend to have the lowest interest rates and lowest monthly repayments.

-

However, interest rates and monthly repayments can go up or down.

Tracker Mortgages in Newcastle

-

Tracker mortgages follow the Bank of England’s base rate.

-

They are often a certain percentage above it, so they do not follow the same interest rate changes as fixed mortgages.

-

Monthly repayments can go up or down with a tracker mortgage.

Get The Best Mortgage Rates In Newcastle

Why Should I Enquire With Deedle?

Purchasing a property is a huge milestone so we are here to help make the process as smooth as possible for you! Deedle prides ourselves in delivering a streamlined process.

We connect you to the best Newcastle mortgage advisers who have access to offers from hundreds of lenders across the market so that they can find you the best deals available in the country. Better yet, our service is free of charge!

Where Can I Get A Mortgage In Newcastle?

You can get a mortgage to purchase a property anywhere in Newcastle. Some sought-after locations include:

- Benton

- Blyth

- Byker

- Carlisle

- Durham

- Elswick

- Gosforth

- Heaton

- High Heaton

- Jesmond

- Kenton

- Kingston Park

- Lemington

- Longbenton

- Ouseburn

- Quayside

- Sandyford

- Walker

Speak To Mortgage Brokers In Newcastle Today

How Can I Qualify For A Mortgage in Newcastle?

To qualify for a mortgage in Newcastle, most lenders will consider:

- Your age

- Your income

- Your employment status

- Your employment history

- Your credit rating

- Your debt-to-income ratio

- The deposit amount

- The desired property’s value

- Your monthly outgoings

What Documentation Is Needed To Apply For A Mortgage In Newcastle?

The following documents are usually requested when being assessed for a mortgage in Newcastle:

- Proof of ID e.g your passport or driving license

- Proof of postal address

- Proof of income (usually the most recent three months of payslips)

- Proof of deposit

- Current or most recent P60

- Your SA302 tax return forms if you are self-employed

- Proof of any bonuses or commission if applicable

Frequently Asked Questions About Mortgages in Newcastle

What Costs Are Associated With Applying For A Mortgage?

If you are looking to get a mortgage in Newcastle, there will be arrangement fees, valuation fees and legal fees. You will also have to factor for the stamp duty land tax if applicable, the monthly mortgage payments, and any other potential expenses such as home insurance, property renovation costs, new furniture or home removal fees.

Does It Take Long For Mortgages To Be Approved in Newcastle?

The entire mortgage process in Newcastle can take anywhere from a few weeks to a few months, from initial application to the final approval and disbursement of funds. Timings largely vary depending on factors such as the lender’s processing time, your financial circumstances, whether you are in a chain and the complexity of the transaction.

Are There Bad Credit Mortgage Brokers in Newcastle?

Yes, there are bad credit mortgage brokers in Newcastle. Deedle will connect you to experienced advisers who will help you get a mortgage even if you have bad credit.

The lender may just offer you slightly higher interest rates due to the larger level of risk involved for them. But do not worry as even with a poor credit history, you should be able to purchase a flat, house, bungalow, maisonette or any other property type in Newcastle.

What Are The Advantages Of Purchasing A Property In Newcastle?

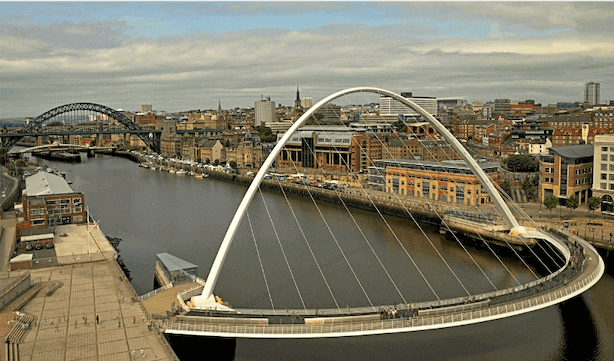

Buying a home in Newcastle has many advantages. The thriving city centre has many shopping and entertainment options including world-famous nightlife. It also has a range of excellent educational institutions and diverse employment opportunities.

Newcastle’s central location in the North East provides easy access to other major cities as well a scenic countryside areas. Moreover, the city’s affordable property prices make it an attractive choice for buyers, with a range of housing choices to suit different budgets and preferences.

Are There Any Government Mortgage Programmes in Newcastle?

Yes, there are government schemes available in Newcastle to help with mortgage affordability. The Help to Buy scheme, for instance, is a programme that offers monetary assistance to eligible buyers when purchasing a property. Newcastle City Council and local housing associations may also offer support or affordable housing options that can help make mortgages more accessible to certain individuals or families.

What Should I Consider Before Applying For A Mortgage?

Before applying for a mortgage in Newcastle, you should do thorough research into all the different mortgage types to gain a clear understanding of what will be best for you. Our dedicated team of Newcastle mortgage advisers will also be able to help explain this all to you.

You should also make sure the terms of your loan is suited to your financial situation. Check if you will be able to afford the monthly payments and that you are comfortable with the interest rate offered. Carefully read all the terms of your contract to make sure you understand key components such as whether there are early repayment charges or what happens if you miss a payment.

What Are The Best Mortgage Rates In Newcastle?

To find the best mortgage rates in Newcastle, you can compare offers from multiple lenders. To achieve this, you should research and contact different banks and building societies who can present you with their best offers.

To make your life easier, you could speak to mortgage brokers operating in Newcastle who can source the most competitive rates for you. If you would like a stress free experience, Deedle can certainly help you with this! Simply fill in our enquiry form and a dedicated mortgage adviser will call you back on the same day to help you find the best deals available.